Reverse Mortgage Loans

Eliminate your mortgage payments & get the cash you need quickly.

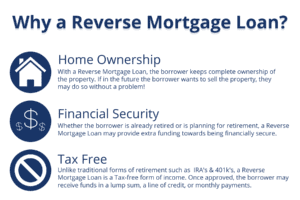

We are a FHA Approved Reverse Mortgage Loan Lender providing reverse mortgage loans for 62+ seniors allowing them to access the equity in their house easily during their lifetimes.

Plan for your retirement and improve your financial situation using a Reverse Mortgage Loan from MCM Capital as your retirement income stream.

Find out how a Reverse Mortgage Loan from MCM Capital Solutions can help secure your financial future by requesting a quote online.

Get An Instant Mortgage Loan Quote

HECM Annual Adjustable Rate

HECM Annual is a reverse mortgage loan whose interest rate adjusts only once a year, with a “lifetime cap” to ensure that your client’s rate will never go beyond a certain percentage over the initial rate. In addition, there’s an “interval cap” that guarantees that the interest rate cannot increase by more than a certain percentage annually. And to help give your client’s financial flexibility, they have the choice of taking their funds as a lump sum, monthly advances, a line of credit or a combination of these.

HECM Monthly Adjustable Rate

The interest rate on this HECM fluctuates on a monthly basis, but it also offers more options for homeowners — including a “rate cap” that guarantees that the rate will never go up more than a certain percent over the initial rate (depending on the loan options they choose). Your customers can select a lump sum draw, line of credit, monthly advances, or a combination of these options. For example, a customer might choose to take some of the cash up front and put the rest in a line of credit, so it’s available when and if they need it.

HECM Fixed Rate

With an interest rate that’s established at the loan closing — and fixed for the life of the loan — your clients always know exactly how much interest is accruing on their loan. However, with a HECM Fixed Rate, homeowners are required to take all of their money at closing in one lump sum. This may be a desirable choice if they’re using their HECM to pay off an existing mortgage or cover other immediate needs.

HECM for Purchase

This home financing solution helps your clients purchase a new home that will better fit their lifestyle by taking out a loan on the home they are buying. If you’re interested in expanding your business with HECM for Purchase, we can help! As an industry leader with this product, we have the keys to unlocking this sales opportunity. We can teach you what you need to know to be successful, show you how to educate consumers as well as realtors and builders who can help you expand your customer base, and give you the support of HECM for Purchase experts.